How Machine Learning and AI transform Banking?

We are living in critical times, where everything is being automated. The digital transformation is so clearly visible to all of us that the modern banks and legacy business systems are investing more in tech automation.

When we talk about technology and automation, Artificial Intelligence (AI) and Machine Learning (ML) are said to be the driving force behind the risk-free digital transformation.

The AI and Machine Learning in banking systems, financial services have led to the starting of new fintech services ready to meet new demands of customers by making banking easy to access from home in a more safe and secure internet-enabled environment.

Thus, in this blog post, you get to know the benefits of AI in banking and how deep learning in banking via ML helps to automate bank services. Let’s start!

Quick Navigation

In the banking system, the biggest pressure is to manage the risk, regulatory requirements, along with growing governance. As the bank tries to expand itself with better and exceptional services, this pressure increases every year.

To decrease this pressure, the banks need to automate most of their services using technologies and data. That’s why fintech companies are using AI and ML to leverage the data, predict customer needs, stop fraudulent activities, and find out the best services for clients/customers.

For accelerating the current banking system, the usage of data science, AI, ML, deep learning, cloud technologies, blockchain services, etc. are now necessary because -

“The significant impact of artificial intelligence in the banking sector is to Mitigate risk management, Protecting fraudulent activities, AI-led software for better services, and doing Algorithm-based marketing to gain profits.”

What are your views on AI software development company working in the banking and finance services sector? Do mention your thoughts in the comment section after you are done reading this blog post!

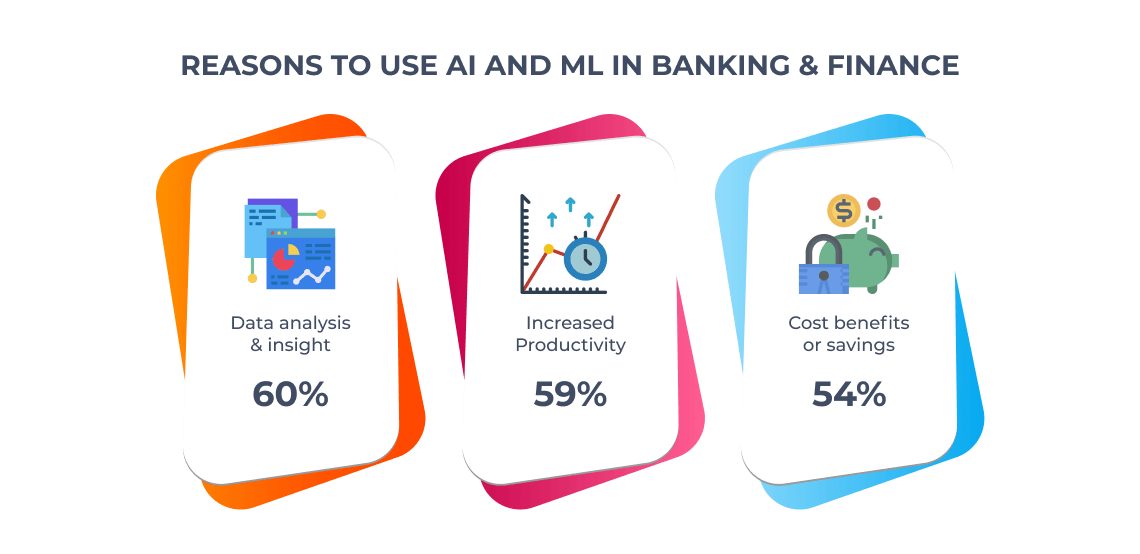

Why Adopt AI and ML in the Banking System?

Every bank customer likes to use speed services directly from the applications and websites. Similarly, banks want to drive deep into customers’ thoughts by collecting data only to annihilate poor customer service.

“57% of the banking executives say that AI and ML will change the banking systems. 49% says that Machine Learning in banking is a key driver in the next 5 years. 45% of executives dream to work in a digital ecosystem with self-built digital services.”

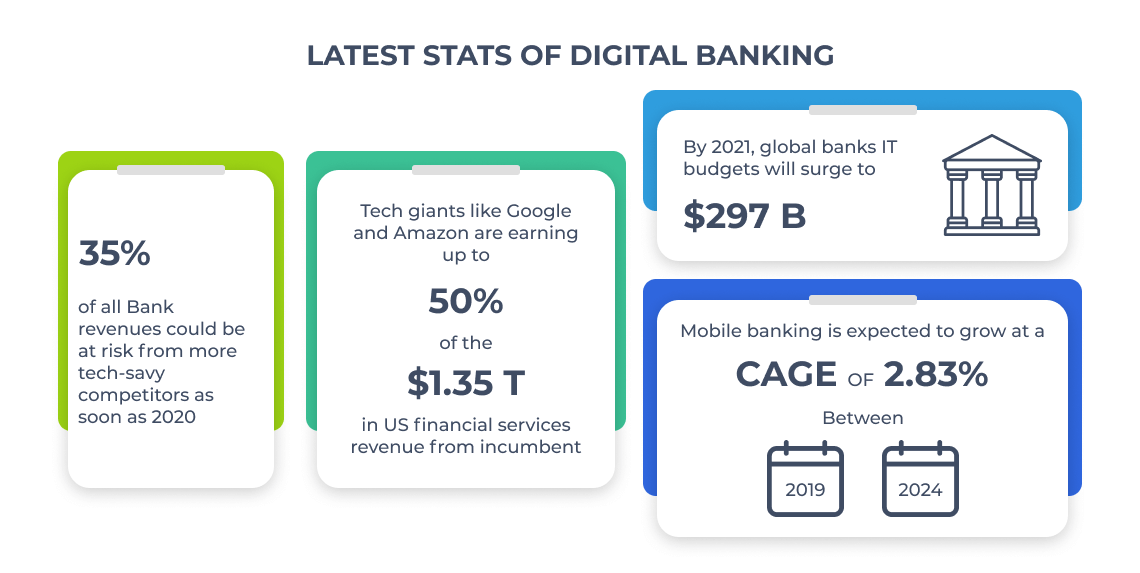

According to reports, the global COVID-19 pandemic has accelerated the pace of banking transformation and a cashless society. Banks already have intense competition with themselves, but the increased usage of technology in the financial services industry might reduce this competition.

We also notice that customers themselves want to explore the tech applications for a better user experience. In this case, if AI and ML provide better personalization to the users, the bank value will rise to higher standards.

Also Read: How FinTech Application Development Transforms the Banking Industry

Along with advanced technologies, DevOps is also significant in digital banking as it helps the bank to shift its focus towards enterprise agility, by bringing software development and IT operations in the banking sector.

“Not only DevOps development services, but cybersecurity services and multi-cloud services in AI-based platforms will put the greatest impact on the banking ecosystem in the coming years.”

What Happens When Machine Learning Comes to Finance and Banking?

In the last couple of years, the banking and finance industry witnessed the power of machine learning in driving data and making algorithms for online banking services.

Financial institutions of various sizes and Fintech companies now believe in the accuracy and fairness of the banking processes; thus, reducing bureaucracy.

Unfortunately, many banks throughout the world are using old methods of banking! They don’t understand the new banking methods and technologies easily manage complex, highly-regulated processes, reduce the banks’ investment, and make the entire system paperless.

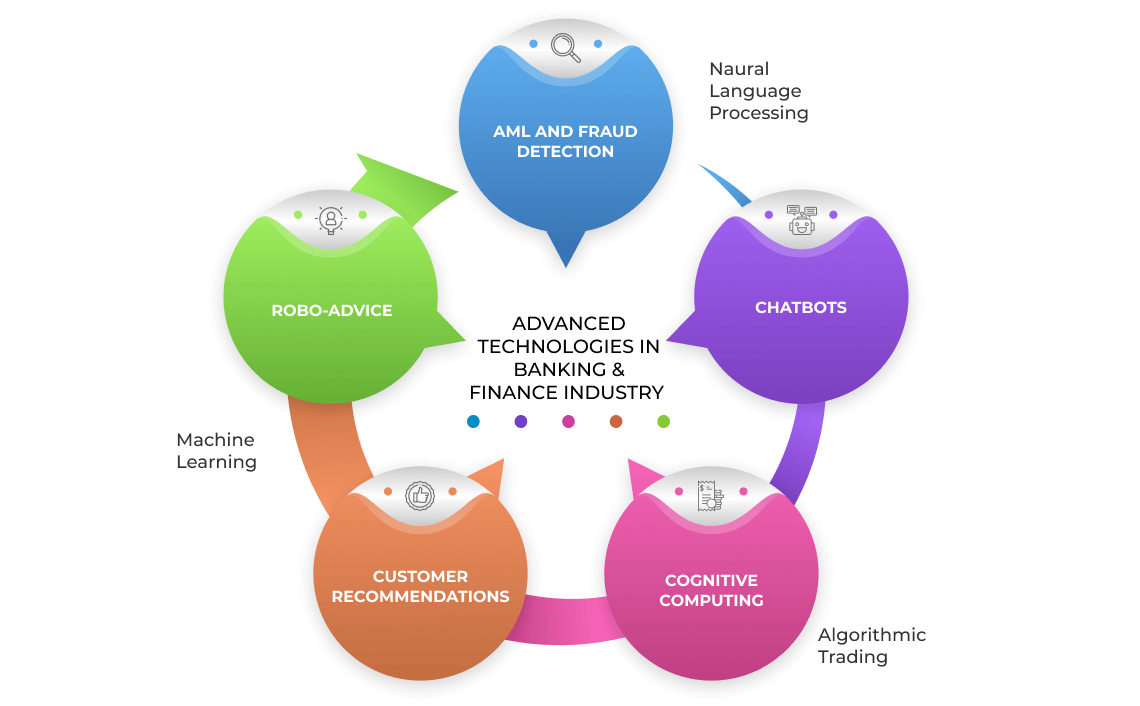

"Though there are challenges, machine learning promises best processes and applications in finance and bank industry by helping in process automation, cybersecurity, algorithmic trading, and Robo-advisory."

Below are some ways how machine learning and deep learning in banking is useful:

- New AI-powered processes help generate new revenue.

- Easy detection of the multidimensional fraud schemes.

- Customers get a more personalized and streamlined banking experience as the bank uses data-driven algorithms.

- Administrative tasks such as risk assessment, underwriting, claims, loss determination, and more are simple to automate.

Machine learning in the banking sector works magically by collecting the best datasets via the right algorithms only to create an efficient banking infrastructure.

For this, the credit goes to a few top banking & financial services providers in USA that are offering benefits of AI in banking by making affordable Core Banking Systems, Online Banking Systems, Mobile Banking Apps, CRM for Banks, ATM Softwares, Payment Gateways, Custom Online Banking Website, Blockchain Services, Enterprise Finance Software, Risk & Asset Management Apps, Cryptocurrency Trading Apps, and many more.

Use of AI and ML in the Digital Banking Ecosystem!

The Digital Banking Ecosystem explores the new banking landscape formed by automating banking services in a new manner with the help of technologies such that the bank adopts digitalization.

When you look at this concept of the digital bank, you clearly notice three important blocks that actually lays out the foundation of a new banking ecosystem. First are technologies like AI/ML, second is the customer data, and the third is cybersecurity.

Once this banking culture is in use, the banks start to evolve continuously by receiving and providing information more and opening new opportunities for the bank at the world level.

Emerging AI and Machine Learning technologies are changing the face of banking by using endless applications in process automation, digitalization, mobile integration, advanced analytics, and more.

Also Read: Machine Learning & AI: Future To Continuous Integration & Delivery

Some best usage of AI and ML in the digital banking ecosystem are conversational banking, fraud detection, smart contracts infrastructure, personalization of customer experience, anti-money laundering, AI biometrics technology, credit underwriting, payment processing, personalized marketing strategy, deep learning in banking.

"As a result, AI and ML will successfully reshape digital banking based on data, augmented performance, customer experiences, easy optimization, and better retention benefits."

What is the Role of IT and Software Development Company in the Banking Sector?

The goal is to make every service digital in the new banking system, banks need to make partnerships with the leading software and IT companies for using AI, ML, Deep Learning, and other technologies.

Banks need fully-developed software solutions to remain top among the competitors. To achieve this mission, they need to address their concerns, problems to the IT companies!

We are the best custom software development company in USA with a team of certified and expert developers ready to deploy all types of customers and clients solutions, mobile applications, software, and services by understanding technical needs properly for financial institutions.

If you have any doubts about AI and ML transforming banking systems, comment it below!